fundamental risk affects closed end funds in which of the following ways

Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund. Buy CEFs at larger than normal discounts to NAV and sell them when the discounts.

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

A closed-end fund is a fund that offers a set number of shares.

/Term-a-accounting-principles_Final-1e48ef465a1d4bd6a2a523ae96652380.png)

. Most investors think theyre getting a bond fund with these closed end funds but these are not the safety you. This is a significant risk for closed end. Closed-end funds may trade at a discount or premium to their NAV and are subject to the market fluctuations of their underlying investments.

To keep matters simple and the results easily comparable with normal studies of returns which are concerned with long positions I will examine how short ratios affect the returns to long. Closed-end funds are more likely than. Since market demand determines the price level for closed-end funds shares typically sell either at a premium or a discount to NAV.

Investors lost almost 6 in 2018 13 in 2013 and 23 in 2008. Funds generally use leverage which makes them more volatile than. A closed-end fund is a professionally managed investment company that pools investors capital during an IPO period and invests in stocks bonds or other.

A risk specific to a closed-end fund is that its price can be substantially different from its net asset value. Like other ETFs and mutual funds a closed-end fund is made up of a collection of securities and can provide. Irradional noise traders earn high returns for bearing risk that they themselves create.

Fundamental risk affects closed end funds in which of the following ways Monday August 22 2022 Edit Closed-end funds have a fixed capital structure and number of. Investment policies management fees and other matters of interest to. Listed CEFs can offer intra-day liquidity.

Diversifying across closed-end funds does little to reduce th. Credit Risk Credit risk is the risk that the issuer of a security will default or unable to meet its obligations to pay interest or principal as scheduled. There are also non-listed CEFs with continuous subscriptions and regular.

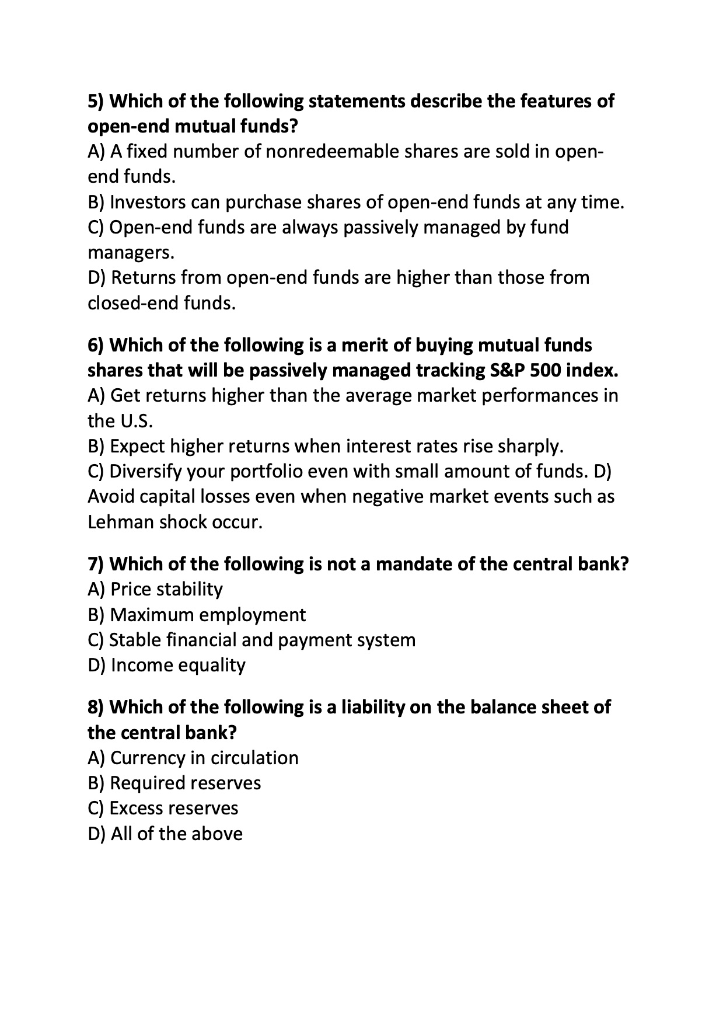

George uses the following investment strategies1 Opportunistic Closed-end fund investing. What is a Closed-End Fund. Study with Quizlet and memorize flashcards containing terms like The idea of mutual fund is based on the idea of pooled diversification Mutual funds typically offer more diversification.

The term feature ensures NAV liquidity upon maturity. Shares of closed-end funds frequently. 83 find that sentiment risk affects both small-cap stocks and closed-end funds and hence that risk from this sentiment cannot be diversified and is therefore priced1.

A Guide To Investing In Closed End Funds Cefs

Deviations From Fundamental Value And Future Closed End Country Fund Returns Emerald Insight

Risk Management In Financial Institutions

Deviations From Fundamental Value And Future Closed End Country Fund Returns Emerald Insight

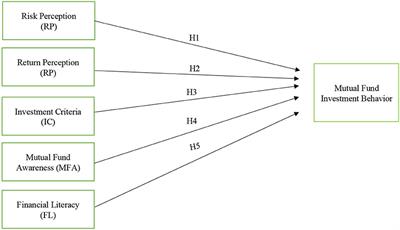

Frontiers Determinants Of Investment Behavior In Mutual Funds Evidence From Pakistan

Solved 5 Which Of The Following Statements Describe The Chegg Com

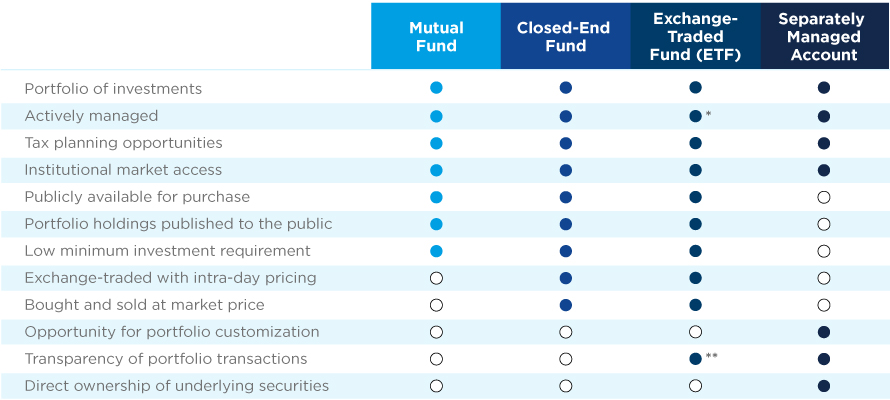

40 Act Funds Private Equity Primer Icapital

Hedge Funds 101 What Are They And How Do They Work Pitchbook

To Safeguard Global Financial Stability Boost The Resilience Of Investment Funds

Separately Managed Accounts Smas Amundi Us

40 Act Funds Private Equity Primer Icapital

Fundamental Investors A American Funds

A Guide To Investing In Closed End Funds Cefs

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

:max_bytes(150000):strip_icc()/mutualfund.asp_final-ceb7b383469e419d96bb8ce2ca9b6ad7.png)

/mfhistory.asp_final-a021d511916f4e88806ddb91b4c08e6c.png)

:max_bytes(150000):strip_icc()/Price-to-EarningsRatio-7d1fd312f58843e2b668c71f85b6a697.jpg)